Over the last year, through the rapidly evolving market and competitive conditions, our team has worked extremely hard to develop a valuable platform for Solana and crypto, including shipping a battle-tested beta of our dynamic vaults protocol.

Throughout all the ups and downs, the core team has not sold a single MER, remaining fully committed to the platform’s long-term success. Our ethos has always been anchored around providing long-term value to benefit users and the ecosystem rather than short-term profit.

We originally conceived a plan in October this year, which involved the investors and team agreeing to suspend MER staking for a year and launch both the dynamic vaults and MER staking. However, this plan is no longer sufficient given the vast amounts of MER involved in FTX, the ongoing ambiguity around the status of Alameda, and the unhealthy association with FTX/Alameda.

Today, we are unveiling The Meteora Plan, which will launch our existing and new product under a new technology platform, and reset the existing tokenomics with the goal of creating a new foundation for participation to reignite user interest and grow market confidence in the platform.

Why Are We Doing This?

Launching a new technology platform, resetting the tokenomics, and rebuilding the community will involve an enormous amount of coordination, discussion, and development over the next year. However, we believe it will be worth it because:

- We have built a solid, battle-tested product in dynamic vaults/AMM that will be important for the future of decentralized yield on Solana.

- We have a dedicated and talented team who have demonstrated relentlessness in innovating, producing, and shipping new products through hard times.

- We have supportive investors who stuck with us through the tough times and supported the various plans we have thrown up.

- The Meteora token will be substantially different from the MER token; Token utility, i.e. governance and value accrual mechanisms will be part of the token.

- The new community DAO will also have substantial leverage over critical decisions like LM allocations to pools, staking rewards, etc. A DAO will help us move towards a more decentralized and community-driven approach to the project.

Last but not least, as the market recovers, DeFi protocols on Solana stabilize, and the user base grows, we envision Meteora as the decentralized yield layer for many users, protocols and dapps

The Meteora Plan

The key goals of Meteora are to ignite user interest, build up market confidence, and set the foundations for the right community and ecosystem for our project to succeed.

To achieve these, we have 3 key parts:

- Launching Dynamic Vaults and AMMs under Meteora

- Migrating to a clean, unambiguous token setup

- Complete brand revamp and transition to Meteora.ag

1/ Officially launching Dynamic Vaults and AMMs under Meteora

We have been developing our beta version of dynamic vaults for several months now. It has undergone audits with Quantstamp and Halborn, and has been battle tested against the recent Mango and Solend exploits.

Dynamic Vaults would not have been possible without Solana’s composability, speed and low transaction fees which provide on-chain event monitoring benefits that exceed any other blockchain.

The vaults rebalance every minute across many lending platforms to find the best yield while prioritizing keeping user funds as accessible as possible, withdrawing whenever utilization in any lending pool becomes too high. In addition, the Meteora platform/token is already valuable without needing LM. It provides value to users and developers through the lending aggregator and earns performance fees from profits.

Currently, we have integrated with over 50 lending pools across six lending platforms and launched 7 Dynamic AMM pools (closed beta) and 7 Dynamic vaults (beta).

As per the Meteora plan, we will launch a new platform consisting of Dynamic vaults, Dynamic AMM pools, and a keeper that helps monitor and rebalance the vault assets every few minutes across lending protocols for optimal yield for the LPs. We will also migrate Mercurial’s v1 stable pools to the new project site to create a cohesive user experience.

We believe Meteora Dynamic Vaults can become the yield layer for all of Solana as it allows any protocol, including wallets, treasuries, and Automated Market Makers (AMMs) to integrate with this layer to earn yield, solving a major problem of capital efficiency.

In addition, users who deposit into protocols that integrate our dynamic vaults, will be able to receive interest and LM rewards from the lending platforms on top of the yield they would receive from these protocols. The added yield will significantly reduce LM as the primary driver of a protocol’s liquidity maintenance and growth.

2/ Migrating To A Clean, Unambiguous Token Setup

The second major part of the plan is launching a new token MET with the launch of the Meteora Platform, and migrating our current MER to a new, clear token setup to create a new economic and community foundation moving forward.

As mentioned earlier, we believe that the confluence of several key factors creates too much uncertainty, and without a strong tokenomic foundation to begin with, the potential of the new platform will be wasted.

Therefore, this token plan aims to set the platform on a new foundation with 3 key goals:

- Remove all ambiguity around the existing tokenomics and give potential new investors strong clarity when deciding whether to participate.

- Bring the ownership of the protocol by the team/investors to a smaller proportion of the new supply.

- Give the new DAO control over the vast majority of the new token supply, so any emissions will be a fully transparent and well-informed process.

With these goals in mind, here is the overview for the new token setup:

- There will be 100M Meteora tokens

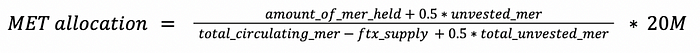

- 20% (20M) will be circulating initially and distributed to MER stakeholders as per the calculations below

- There will be no increase in circulating supply or emissions until the DAO approves

To achieve this clarity, we will be taking the following steps:

- Taking a snapshot of all the MER holdings in the first week of January 2023

- For the unvested portion of the token holdings for the team, investors, and key partners, only 50% of the unvested token holding will be considered for the migration.

- The hacked FTX tokens will not be considered in this migration. The DAO will decide in the future what to do with this when the state of this clears up.

Therefore:

For holders with unvested MER:

For others,

Under the new setup, it will be a clean and liquid 20%, with 80% of the token supply given to the DAO to manage and make decisions over future token emissions. New potential stakeholders can in turn decide how much they would like to be involved, and the price discovery will happen over the next few months.

This plan allows us to clear all uncertainties surrounding our tokenomics and pave the way for a clean and transparent token setup for the ecosystem and project moving forward.

3/ Complete Brand Revamp And Transition To Meteora.Ag

We are revamping our brand with a new logo, community building strategy, and transiting to a new domain — Meteora.ag. As mentioned above, the existing v1 stable pools will also be migrated to the new site to maintain a consistent user interface.

Tentative Timeline

The tentative timeline for the plan is as follows:

Bootstrapping Meteora In 2023

The first year of Meteora will be crucial in terms of bootstrapping several key aspects of the project — platform liquidity, token liquidity, project governance and community interest.

The great news is that we are not starting from scratch — we already have a valuable, audited, and battle-tested platform and a network of investors and community members who have been with us since early on.

We will be setting up MET staking and governance early in the process to help brainstorm, discuss and decide how to make Meteora one of the top projects in Solana and in DeFi.

Jupiter is a project that was initially started as a Mercurial integration to help make stablecoins on Solana more easily swappable with other tokens. Since then, Jupiter have gone on to become a cornerstone of Solana Defi. As such, Mercurial has been a key partner in helping to bootstrap Jupiter. With that in mind, the Meteora DAO will receive an allocation for any future Jupiter token based on the appropriate tokenomics for Jupiter, likely with the same vesting terms as other stakeholders.

The key here will be to allow Jupiter to focus on building the best tokenomics, platform and community possible, while rewarding existing MER stakeholders and helping bootstrap Meteora.

We are extremely excited to work with the community on these ideas. Along with our optimism about Solana recovering over the next couple of years to become one of the blockchains driving crypto forward — 2023 will be a crucial year for us to work with the community and ecosystem to achieve that.

Be Part Of The Meteora Plan

From now till the snapshot event, we welcome all feedback and suggestions on how we can further improve our proposed token migration event.

If you are a current MER holder, there is no need to do anything, your MER tokens will be automatically migrated over to the Meteora token. If you are not a MER holder, but want to get involved in helping make decisions with the DAO, you can obtain MER tokens anytime before the snapshot, or Meteora tokens after it is launched to be part of the Meteora Plan.

After the snapshot, we will proceed to launch the Meteora platform, token release, and governance set up. If you’re excited by our plan, we would love your involvement in finalizing the details of The Meteora Plan. Your feedback, suggestions and ideas will be crucial to shaping the implementation details of the plan — both before or after the plan!

Next Steps

- We will be holding a community call that everyone is welcome to join and share their thoughts

- We will prepare to do the snapshots of the allocation for the token migration.

- We have begun the resumption of liquidity allocation to lending pools. We will continue assessing the lending landscape, resuming distribution, and adding new integrations, e.g. drift, etc.

- We will also release the launch video, whitepaper, and lending protocol assessments report. These documents/reports will provide further insights into our platform and the overall status of the lending landscape, giving our users and community clarity, and more confidence in the road ahead.

We are incredibly grateful to the ecosystem for the very strong support it has shown us all this while. Despite the challenges that we had faced so far, we are thankful for the chance to have experienced them and battle-tested our product. We learnt a lot of valuable lessons across the entire stack.

Looking forward to working together with you to create a new basis for a bright future for Meteora and Solana, and to be a shining example for all of crypto.

Twitter: https://twitter.com/MercurialFi

Discord: discord.gg/WwFwsVtvpH